Welcome to Florida, where the sun shines, the beaches beckon, and the roads wind their way through beautiful landscapes. If you’re a car owner in the Sunshine State, understanding car insurance quotes is essential to ensure you have the coverage you need. Navigating the world of car insurance can be confusing, but with a little knowledge and guidance, you can find the right policy for your needs and budget.

Understanding Car Insurance Requirements in Florida

When it comes to car insurance in Florida, it’s essential to understand the requirements set by the state. Florida is a no-fault state, which means that drivers are required to carry personal injury protection (PIP) coverage. This coverage helps pay for medical expenses and lost wages in the event of a car accident, regardless of who is at fault. In Florida, drivers are required to carry a minimum of $10,000 in PIP coverage, as well as $10,000 in property damage liability (PDL) coverage.

In addition to PIP and PDL coverage, drivers in Florida are also required to carry bodily injury liability (BIL) coverage. This coverage helps pay for injuries suffered by others in an accident that you are found to be at fault for. The state of Florida requires drivers to have a minimum of $10,000 per person and $20,000 per accident in BIL coverage. It’s important to note that these are just the minimum coverage requirements set by the state, and drivers may choose to purchase additional coverage for added protection.

Another important factor to consider when it comes to car insurance in Florida is uninsured motorist coverage. This coverage helps protect you in the event that you are involved in an accident with a driver who does not have insurance or does not have enough insurance to cover the damages. While uninsured motorist coverage is not required by law in Florida, it is highly recommended as it can provide added peace of mind knowing that you are protected in the event of an accident with an uninsured driver.

Failure to carry the required minimum insurance coverage in Florida can result in fines, license suspension, or even vehicle impoundment. It’s important to make sure that you have the proper insurance coverage in place to avoid these consequences and to protect yourself financially in the event of an accident. By understanding the car insurance requirements in Florida and making sure that you have the necessary coverage, you can drive with confidence knowing that you are protected on the road.

Factors Affecting Car Insurance Quotes in Florida

When it comes to obtaining a car insurance quote in Florida, there are several factors that insurance companies take into consideration. These factors can have a significant impact on the cost of your insurance premiums. Understanding these factors can help you navigate the process and potentially save money on your car insurance.

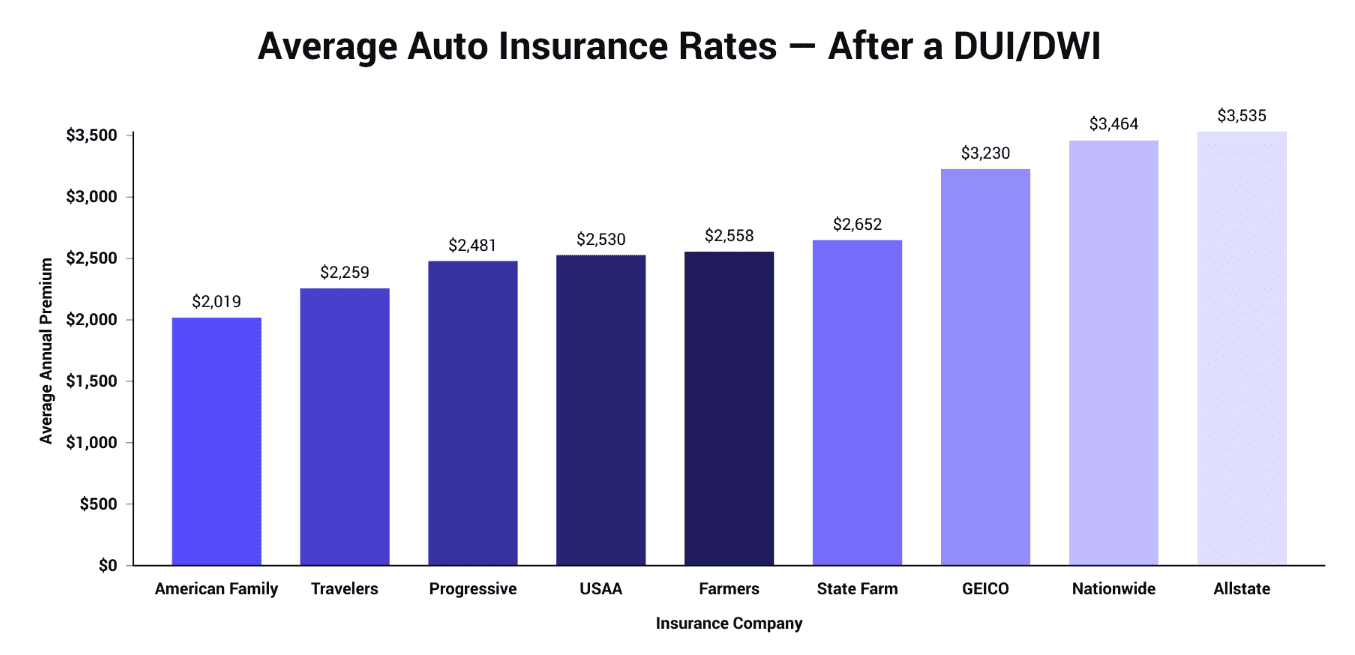

One of the primary factors that affect car insurance quotes in Florida is your driving record. If you have a history of accidents or traffic violations, insurance companies may see you as a higher risk and charge you more for coverage. Conversely, if you have a clean driving record with no infractions, you may be eligible for lower premiums.

Another important factor that insurance companies consider when calculating car insurance quotes in Florida is your age and experience as a driver. Younger, less experienced drivers are often charged higher premiums due to their increased likelihood of being involved in accidents. On the other hand, older, more experienced drivers may be able to secure lower rates.

The type of vehicle you drive can also impact the cost of your car insurance in Florida. Insurance companies take into account factors such as the make and model of your car, its age, and its safety features when determining your insurance premiums. Generally, newer, safer vehicles will result in lower insurance costs.

Where you live in Florida can also play a role in the cost of your car insurance quotes. Urban areas with higher crime rates and more traffic congestion typically have higher insurance premiums than rural areas with lower population densities. Additionally, your zip code can impact your rates, as some areas may have higher rates of accidents or theft.

Your credit score is another factor that insurance companies may consider when calculating your car insurance quotes in Florida. Studies have shown that drivers with lower credit scores are more likely to file claims, leading to higher insurance costs. Improving your credit score can help you secure better rates on your car insurance.

Lastly, the coverage options you choose can also affect the cost of your car insurance in Florida. Opting for higher coverage limits or additional coverage options, such as comprehensive or collision coverage, will result in higher premiums. On the other hand, selecting lower coverage limits or choosing a higher deductible can help you save money on your car insurance.

Overall, there are many factors that can influence the cost of car insurance quotes in Florida. By understanding these factors and how they impact your premiums, you can make informed decisions to potentially lower your insurance costs. Shopping around and comparing quotes from multiple insurance companies can also help you find the best coverage at the most affordable price.

Comparing Car Insurance Quotes from Different Providers in Florida

When it comes to getting car insurance in Florida, shopping around and comparing quotes from different providers is key to finding the best coverage at the best price. With so many insurance companies offering policies in the state, it can be overwhelming to sift through all the options. However, taking the time to compare car insurance quotes can save you money and ensure you have the coverage you need.

One of the first steps to comparing car insurance quotes in Florida is to determine how much coverage you need. This will depend on factors such as the value of your car, your driving record, and your personal preferences. Once you have a clear understanding of the coverage you need, you can start getting quotes from various insurance providers. You can do this by contacting insurance companies directly or using online comparison tools to get multiple quotes at once.

When comparing car insurance quotes, it’s important to consider more than just the price. While cost is a significant factor, it’s also crucial to look at the coverage limits, deductibles, and any additional benefits or discounts offered by each provider. Make sure to read the fine print of each policy to understand what is covered and what is not, as well as any limitations or exclusions that may apply.

Another factor to consider when comparing car insurance quotes in Florida is the reputation and customer service of the insurance provider. Look for reviews and ratings from other policyholders to get a sense of how the company treats its customers and handles claims. A reliable insurance provider with good customer service can offer you peace of mind knowing that you will be well taken care of in the event of an accident.

Additionally, it’s essential to review the financial stability of the insurance companies you are considering. You want to make sure that the provider you choose will be able to meet its obligations and pay out claims when needed. You can check the financial ratings of insurance companies through independent rating agencies such as A.M. Best or Standard & Poor’s.

Lastly, when comparing car insurance quotes in Florida, don’t forget to ask about any discounts or ways to save money on your premium. Many insurance companies offer discounts for things like having a clean driving record, taking a defensive driving course, bundling multiple policies, or installing safety devices in your car. Taking advantage of these discounts can help lower your premium and make your insurance more affordable.

Tips for Getting the Best Car Insurance Quote in Florida

Getting a car insurance quote in Florida can be a daunting task, but with the right knowledge and preparation, you can secure the best deal possible. Here are some tips to help you navigate the process and find the best car insurance quote in Florida:

1. Compare Multiple Quotes: One of the most important things you can do when looking for car insurance in Florida is to compare quotes from multiple providers. Every insurance company has different rates and coverage options, so it’s essential to shop around and see what each one has to offer. By comparing quotes, you can ensure that you are getting the best price for the coverage you need.

2. Consider Your Coverage Needs: Before getting a car insurance quote in Florida, take some time to consider your coverage needs. Do you need full coverage, liability-only, or something in between? Understanding what type of coverage you need will help you narrow down your options and find a policy that fits your needs and budget.

3. Check for Discounts: Many insurance companies offer discounts for things like safe driving habits, bundling multiple policies, and being a good student. Before settling on a car insurance quote in Florida, be sure to ask about any discounts that may apply to you. These discounts can help lower your premium and save you money in the long run.

4. Improve Your Driving Record: Another way to secure a better car insurance quote in Florida is to improve your driving record. Insurance companies often base their rates on your driving history, so having a clean record can help you qualify for lower premiums. To improve your record, practice safe driving habits, avoid speeding tickets and accidents, and consider taking a defensive driving course.

By following these tips, you can increase your chances of getting the best car insurance quote in Florida. Remember to shop around, consider your coverage needs, check for discounts, and work on improving your driving record. With a little time and effort, you can find a car insurance policy that meets your needs and fits your budget.

Common Mistakes to Avoid When Getting a Car Insurance Quote in Florida

When it comes to getting a car insurance quote in Florida, there are some common mistakes that many people make. These mistakes can end up costing you more money or leaving you with inadequate coverage. To help you avoid these pitfalls, here are 5 common mistakes to watch out for:

1. Not Comparing Quotes: One of the biggest mistakes you can make when getting a car insurance quote in Florida is not comparing quotes from different insurance companies. Each company uses different criteria to determine rates, so you could be missing out on a better deal if you only get a quote from one company. Take the time to shop around and compare quotes from multiple insurers to ensure you are getting the best coverage at the best price.

2. Providing Inaccurate Information: Another common mistake when getting a car insurance quote is providing inaccurate information. Whether it’s forgetting to mention a recent traffic violation or underestimating your annual mileage, inaccuracies can lead to higher premiums or even a denied claim in the future. Be honest and upfront with your insurance company to ensure you are getting an accurate quote and the coverage you need.

3. Choosing the Minimum Coverage: While it may be tempting to opt for the minimum coverage required by law to save money on your car insurance premium, it can end up costing you more in the long run. The minimum coverage may not provide enough protection in the event of a serious accident, leaving you responsible for costly repairs or medical bills. Consider your individual needs and the value of your vehicle when selecting coverage options to ensure you are adequately protected.

4. Ignoring Discounts: Many insurance companies offer discounts for various reasons, such as having a clean driving record, bundling multiple policies, or installing safety features in your car. Failing to take advantage of these discounts can result in higher premiums than necessary. Be sure to ask about any available discounts when getting a car insurance quote in Florida to potentially save money on your coverage.

5. Not Reviewing Your Policy Regularly: Once you have obtained a car insurance quote and purchased a policy, it’s important to review it regularly to ensure it still meets your needs. Life changes, such as moving to a new address, adding a teenage driver to your policy, or purchasing a new vehicle, can affect your coverage requirements and premiums. By reviewing your policy annually or after any significant life events, you can make adjustments as needed to ensure you have the right coverage at the right price.

Originally posted 2024-10-15 19:50:42.